Chime referral codes

What is Chime ?

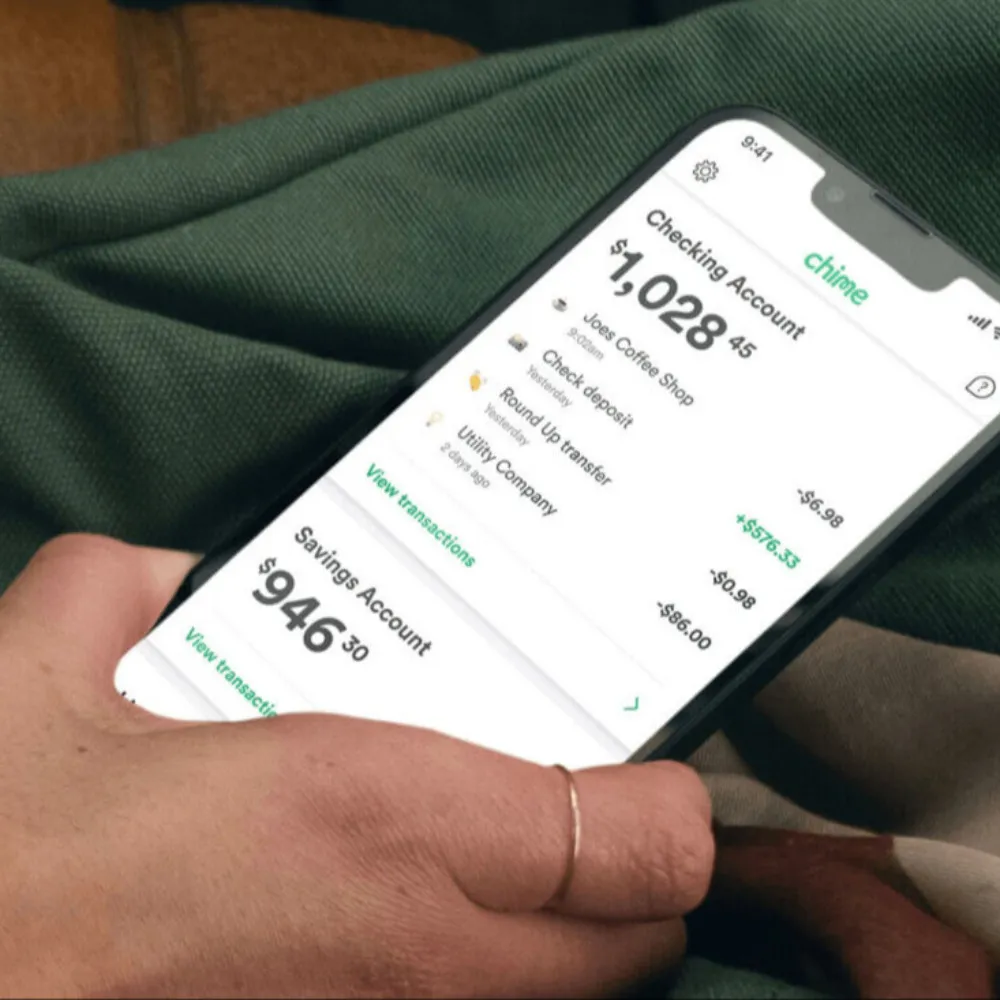

Chime is a modern banking platform that operates primarily through its mobile application, offering users a range of financial services without the need for physical branches. Founded in 2013, Chime has gained popularity for its user-friendly interface and commitment to providing accessible banking options, particularly for those who may be underserved by traditional banks. One of Chime's key features is its early direct deposit service, which allows users to access their paychecks up to two days earlier than traditional banks typically release funds. This feature can be particularly beneficial for individuals living paycheck to paycheck or those who rely on timely access to their earnings.

2x Cashback

Open

Raisin

Raisin connects you with a range of banks offering deposit-protected savings accounts with competitive interest rates, making it easier for you to grow your money.

50

Open

$250

Open

70€

Open

Betterment

Betterment is an American financial advisory company which provides digital investment, retirement and cash management services.

0.5% APY boost= 4.5%

Open

Wealthfront

Wealthfront Inc. is a financial services company. It leverages online banking serving some of the highest APYs of for high yeild savings accounts and is one of the leading roboadvisors in the industry.

4.5%APY

Open

PAYBACK American Express®

Bezahlen und punkten mit einer Karte.

Ihre Kartenvorteile:

- Dauerhaft ohne Kartenentgelt

- Zahlen und Punkten mit einer Karte

- 1 Extra-Punkt je 3 Euro Umsatz bei jeder Kartenzahlung1)

- Eine Zusatzkarte inklusive

- 90 Tage Rückgaberecht: Bei vielem, was Sie mit Ihrer Karte bezahlen, ob on- oder offline, profitieren Sie von einem 90-tägigen Rückgaberecht.

Weitere Kartenleistungen im Überblick:

- Bei vielen Millionen Akzeptanzstellen weltweit - von A wie ALDI bis Z wie Zalando - online und vor Ort sicher bargeldlos bezahlen – auch kontaktlos

- Einfach, schnell und sicher mobil mit Apple Pay, Google Pay und Payback Pay zahlen

- Regelmäßig attraktive Angebote ausgewählter Partner

- Überblick über den Kontostand mit der kostenfreien Amex DE App

- Persönlicher Telefonservice rund um die Uhr

4000 Paybackpunkte

Open

10 trees

Open